About

Carousel seeks to produce the best possible results to executives and investors by delivering on our promises.

For over 25 years, Carousel has invested in what we believe are strategically important middle market businesses in the Southeastern U.S. That’s why as you get to know us, you’ll find we are one of the most well-referenced private equity groups around and, we think, the most well-referenced private equity group with our strategy and focus.

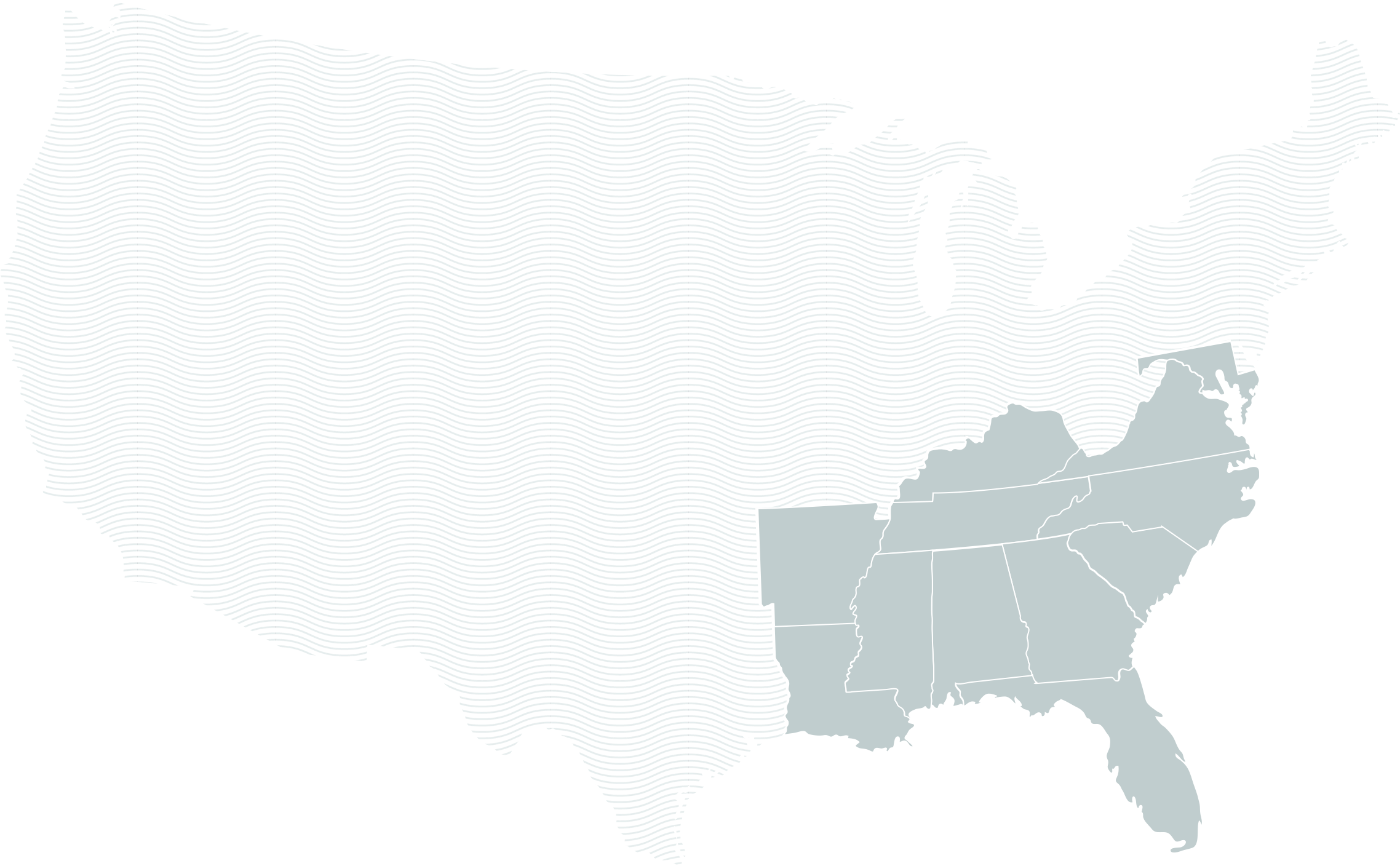

Southeastern Focused

The Southeast produces the largest GDP, has the second highest net private sector job growth, and is the most populous of any geographic region in the U.S. If ranked among countries globally, the Southeast would represent the third largest economy in the world.

Why Carousel

Since its founding in 1996, Carousel Capital has earned a reputation with both investors and business owners for successful investing within the Southeast.

Carousel’s strong CEO investor network, direct deal sourcing capabilities, experienced investment team, and successful investment track record uniquely position the firm to be the partner of choice for buyout opportunities within the Southeast.

Relationship Driven

Focused on Partnerships with Entrepreneurs in the Southeast.

The team that built Carousel’s business over the last two decades is engaged in every investment and we believe can relate to the experiences of management teams and shareholders in building their businesses.

Defined by the term which the Fund(s) held majority control of the investment.